Things to Check Before Buying Your First Home

The home-buying landscape has experienced a big positive transformation. The real estate industry is currently more organised, transparent, and regulated. The home-buying process has developed substantially, contrasting greatly from what our parents may have encountered. There is a much-reduced list of concerns if you are starting on the road to buying your first house. Here, we provide a clear checklist of factors to keep in mind while looking for a new house.

Identify your goals

Begin by stating what you want for the property: Is it for investment or personal use? For investment, evaluate rental prospects and area appreciation rates to guide your decision. If it's for personal use, list your top priorities, such as location, layout, and facilities.

Learn About Expenses

Once you've decided on the layout and a few suitable locations, the next step is to learn about the approximate costs associated with the properties. The pricing will vary depending on aspects like location, developer, and facilities given. Familiarizing yourself with these costs is crucial for the next critical step: budgeting.

Plan Your Financial Scope

Once you've figured out how much the house will cost, the next thing to do is create a budget. Consult with your bank to determine your loan eligibility, which normally covers 80–90% of the cost of the home. The remaining funds for the down payment must be budgeted. Include extra charges in your budget, such as registration fees, maintenance costs, and potential interior expenses. The Equated Monthly Installments (EMIs) on your house loan should not exceed 35% of your overall income. Going above this limit may have a negative impact on your savings. Also, set aside money for an emergency fund to help you in case of an emergency.

Choosing between under-construction and move-in-ready projects

If you don't mind waiting a few months or perhaps a year to move into your new flats in Kochi or anywhere in Kerala, an under-construction property may be right for you. This option provides a greater selection of unit possibilities as well as potential cost savings. However, it is essential to recognise that this alternative carries the risk of project delays. If you need to move in quickly, a ready-to-move-in property is the way to go. Although ready-to-move-in properties may be slightly more expensive, the advantage is being able to physically inspect the apartment before purchase, guaranteeing both quality and adherence to specified standards. Whatever you decide, make sure the project is registered with the Real Estate Regulatory Authority (RERA) and choose a developer with a good track record.

Prioritise Amenities According to Your Interests

Modern real estate projects provide a wide choice of amenities for people of all ages, from children to elders. While a project with extensive amenities offers an improved way of life, it is important to examine the associated costs during purchase and maintenance. Consider these costs before making your decisions.

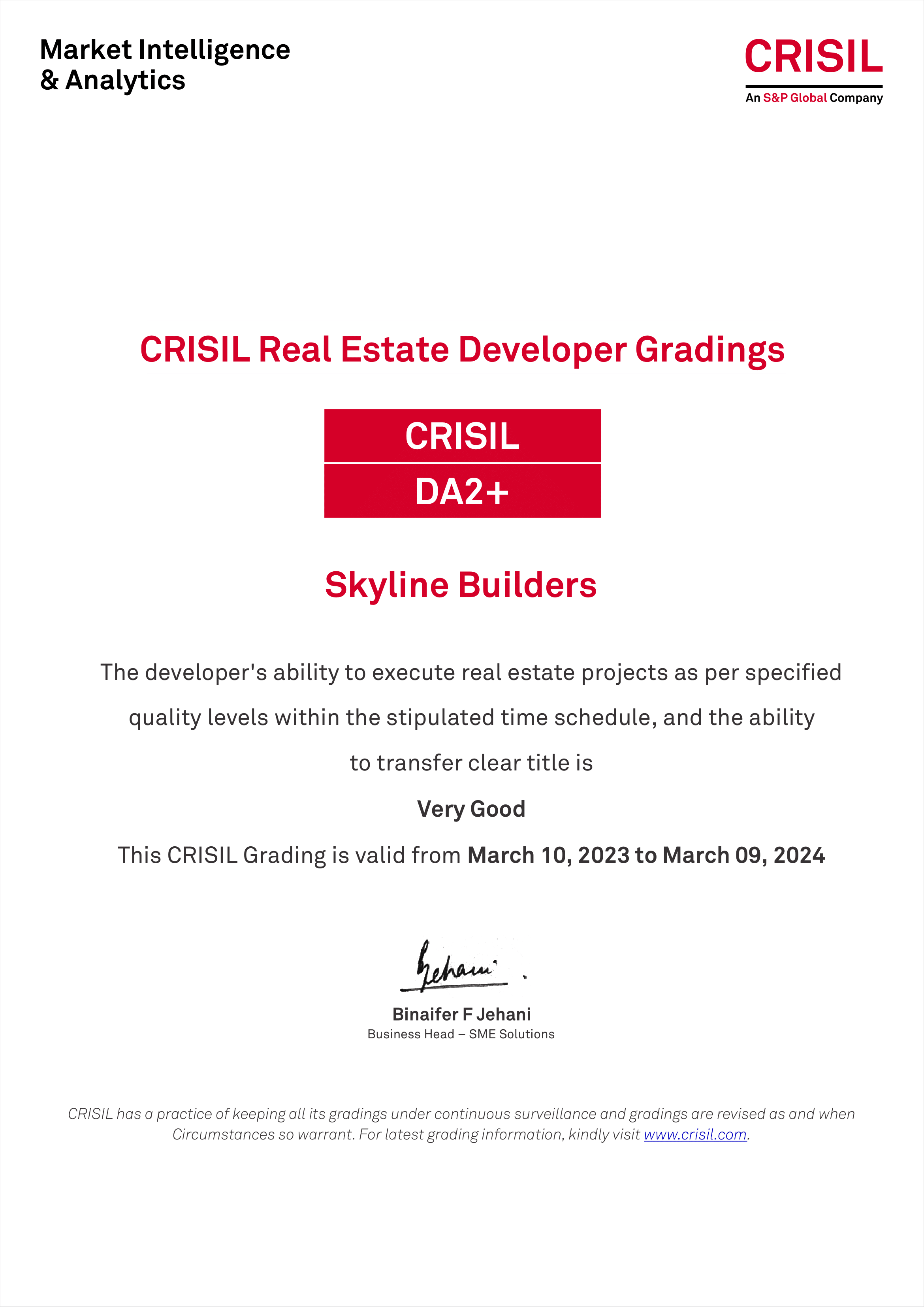

Choose a Reputable Developer's Project

Given the significant financial commitment involved in purchasing a home, it is important to select reputed builders in Kerala. Assess the developer's background and track record of project delivery. While lesser-known developers may offer bigger savings, there is the risk of project delays and low building quality. Prioritise developers who are known for their consistent delivery and high-quality buildings.

Conduct Extensive On-Site Research

Once you've identified the location and project, make frequent trips to obtain information from locals and property experts educated with the area. Repeat visits will allow you to assess the area's connectivity and accessibility to basic services such as water and power.

Maintain a High Credit Score

Because banks have tight loan rules, it is vital to keep a credit score above 750 (range from 300 to 900). Maintaining a healthy credit score on a regular basis, rather than just when borrowing, is critical. A declining credit score may result in higher interest rates being imposed by banks in the future.

Ensure Complete Documentation

Before investing in an under-construction project, make sure it has RERA accreditation. Cross-reference project details on the RERA website to ensure that promised parameters, such as configuration, project status, and delivery date, correspond to the developer's claims. Compare the layout and claimed amenities of ready-to-move properties to the plan. Ensure that the property has gotten the relevant no-objection certifications (NOCs).

Research Subsidies and Tax Benefits

Conduct an extensive study on possible tax breaks and government support for property investment. You can deduct a certain amount of principal and interest payments from your taxes. If your projected property falls into the government-defined affordable housing category, you may be eligible for programmes such as PMAY.

Your First Home Journey Begins with Skyline Builders

Take on the remarkable journey of owning a home with Skyline Builders as you start finding your first home. Skyline Builders, with a solid reputation in the construction sector, offers homes that are built for life. Their dedication to superior quality control, combined with a track record of keeping commitments, ensures that your first home has been built on trust and excellence. Skyline Builders means choosing a route of comfort, reliability, and a future filled with cherished memories in your very own first home, from innovative designs that represent modern living to a commitment to customer satisfaction.

6623aef287d94.png)

63a1a9682edce.png)