- Home

- Frequently Asked Questions

F.A.Qs

Everything you need to know about the projects and services. Can’t find the answer you’re looking for? Please chat with us.

Real estate has always been one of the best investment options. Since the population is increasing, the accommodation requirements are also going up considerably. This assures guaranteed ROI.

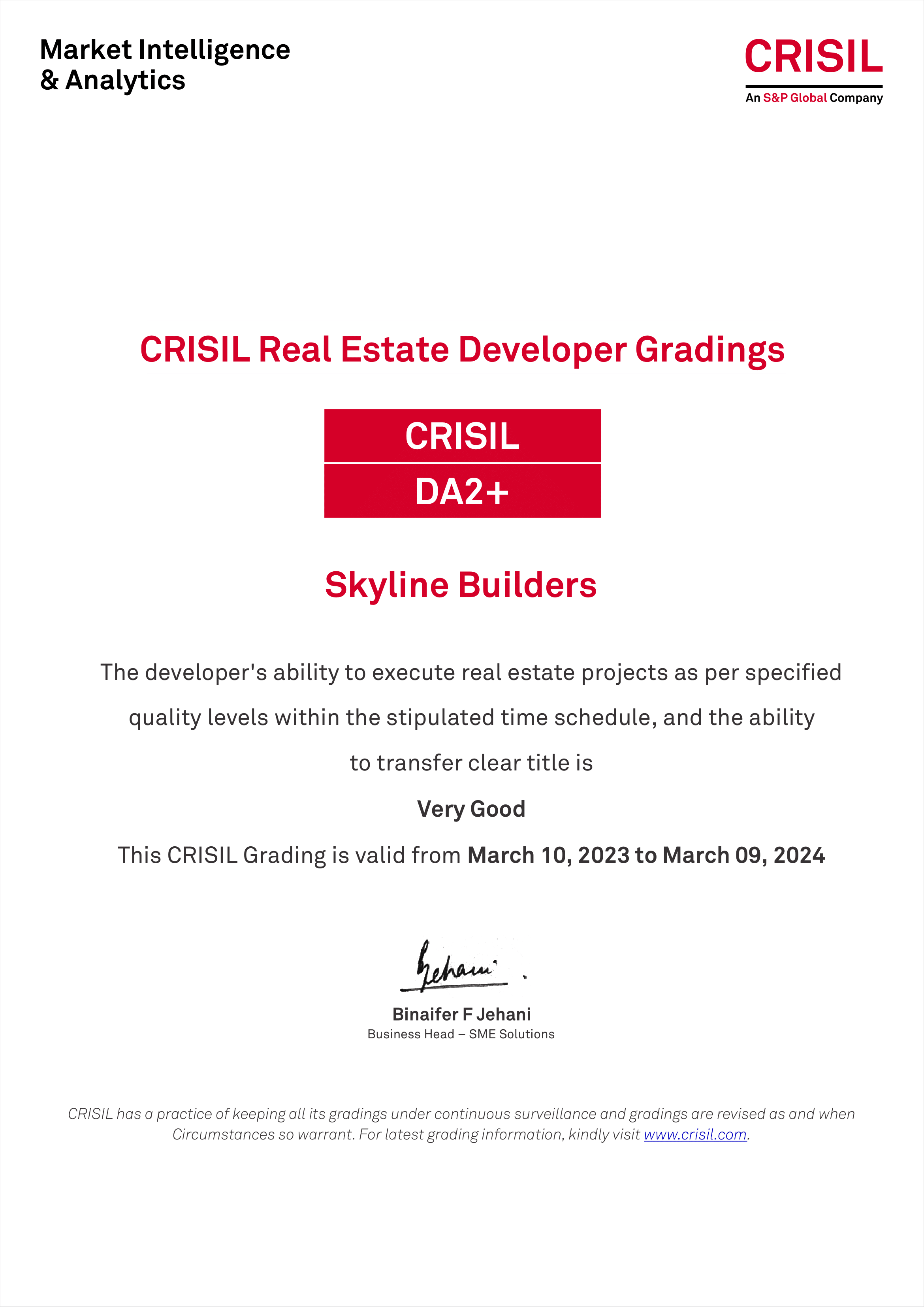

Skyline Builders has been a very prominent real estate developer in Kerala and has done around 154 projects, of which a good percentage are luxury villas and apartments. Skyline understands what opulent living means and curates the entire space to live up to the grandeur element.

All of the projects offered by Skyline Builders provide to-notch service amenities like swimming pools, premium clubhouses, indoor and outdoor sports facilities, gyms, etc.

No permission is required by non-resident Indian nationals to acquire immovable property in India.

Yes, Foreign nationals of Indian origin, whether resident in India or abroad, have been granted general permission to purchase immovable property in India.

The purchase consideration should be met either out of inward remittances in foreign exchange through normal banking channels or out of funds from NRE/FCNR accounts maintained with banks in India.

Yes, Foreign nationals of Indian origin, whether resident in India or abroad, have been granted general permission to purchase immovable property in India.

Non-resident Indians who are staying abroad may enter into an agreement through their relatives and/or by executing the Power of Attorney in their favour as it is not possible for them to be present for completing the formalities of purchase (negotiating with the builder or Developer, drafting and signing of agreements, taking possessions, etc) These formalities can be completed through some known person who can be given the Power of Attorney for this purpose. Power of Attorney should be executed on the stamp paper before the proper authorities in foreign countries. Power of Attorney cannot be drafted on the stamp paper bought in India.

They are required to file a declaration in form IPI 7 with the Central Office of Reserve Bank at Bombay within a period of 90 days from the date of puchase of Immovable property.

They are required to file a declaration in form IPI 7 with the Central Office of Reserve Bank at Bombay within a period of 90 days from the date of puchase of Immovable property.

No. Such income cannot be remitted abroad and will have to be credited to the ordinary non-resident rupee account of the owner of the property.

As Per RBI Regulations

(a) A person who has acquired the property U/s 6(5) of FEMA or his successor cannot repatriate the sale proceeds of such property without RBI approval.

(b) Repatriation up to USD 1 million per financial year is allowed, along with other assets under (Foreign Exchange Management (Remittance of Assets) Regulations, 2016) for NRIs/ PIOs and a foreign citizen (except Nepal/ Bhutan/ PIO) who has (i) inherited from a person referred to in section 6(5) of FEMA, or (ii) retired from employment in India or(c) is a non-resident widow/ widower and has inherited assets from her/ his deceased spouse who was an Indian national resident in India.

(c) NRIs/ PIOs can remit the sale proceeds of immovable property (other than agricultural land/ farm house/ plantation property) in India subject to the following conditions:

i) The immovable property was acquired in accordance with the provisions of the foreign exchange law in force at the time of acquisition or the provisions of Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations 2018;

ii) The amount for acquisition of the property was paid in foreign exchange received through banking channels or out of the funds held in foreign currency non-resident account or out of the funds held in non-resident external account;

iii) In the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties.

Yes, Foreign nationals of Indian origin, whether resident in India or abroad, have been granted general permission to purchase immovable property in India.

IGBC or Indian Green Building Council examines the construction, ascertains whether it meets the energy and environment principles and awards the certification. The IGBC Certification confirms the eco-friendly construction of the buildings. The constructions that maintain a healthy balance between established construction methods and innovative concepts can obtain certification.

Location, cost, affordability, and dimensional specifications vis-à-vis requirements are the things to consider while buying a home in Kerala or anywhere else. Buy the home from a trusted builder only. To ensure the quality and comfortable living experience.

People often buy apartment, flat, or villa from unreliable real estate developers. This can create a lot of troubles like delay in handing over of the home, lack of quality, remote location, and design deficiencies. Buy a home from trusted builders only. Check the location, study about the builders and assess their reliability, research about the prices, and undertake the inspection before buying the home.

Pre-booking is a financially beneficial option for the homebuyer, as per industry experts. It is a safe investment as well. Nonetheless, confirm home trustworthy the real estate developer is, before investing.

Reach out to us

Skyline House, NH Bypass, Near EMC, Kochi - 682 028

AWARDS & AFFILIATIONS

Awards, affiliations, and certifications that state and affirm who we are

6623aef287d94.png)

63a1a9682edce.png)

Stay Tuned

Subscribe to our newsletter and never miss our news and latest updates

- Disclaimer

- Privacy Policy

- Designed & Developed By SpiderWorks