10 Essential Tips for Buying an Apartment on a Single Income

In the past few years, the scenery of homeownership has changed, and now we have more single-income families that want to be owners of their homes. The journey of purchasing an apartment on one salary, however, comes with various difficulties and financial hurdles. This leads to an increased risk of financial failure and thus makes strategic planning and wise financial management more critical than ever.

In this blog, we'll take you through ten powerful tips that can equip you with the skills to thrive in this new environment. From budgeting wisely to all potential costs understanding, these insights can help you make informed decisions, and to manage your finances efficiently so that your dream of an apartment becomes a reality.

10 Tips For Buying An Apartment on a Single Income

Let's check out sme tips for buying an apartments in Kerala on a single income.

Tip 1: Assess Your Financial Health

The process of acknowledging your financial status is the first thing you need to consider when you are in quest of a house. Your credit score, the amount of your income according the your debt, and your financial background in general decide whether or not you will get a mortgage. Get your credit report and fix any mistakes at first. Being certain about your financial position will help you set achievable targets and have a perfect plan for your future apartment search. Spare the time and do a financial fitness check prior to the beginning of your apartment hunt; this will help you have a smooth ride and eventual success.

Tip 2: Budget Wisely

A realistic budget is the foundation. Begin with an itemized list of your monthly income and expenses to find out how much you can afford to save for a down payment. Do not forget to also mention your regular bills as well as possible unexpected charges like emergency repairs. This money saving plan will not only help you to save towards your down payment but also assist you to cover other homeownership costs in future.

You can also read: Why Buying Property In Kerala Is Considered One Of The Safest Investment Options

Tip 3: Save for a Substantial Down Payment

A larger down payment can significantly reduce your monthly mortgage payments, making homeownership more accessible on a single income. Aim to save at least 20% of the home's cost if possible.

Tip 4: Explore Loan Options

Indian home loan market comprises various types of home loan products, which differ in their features and can be utilized as per the existing financial needs. When it comes to a one-income family, opting for the correct mortgage program is a key factor. Seek prospects such as Pradhan Mantri Awas Yojana (PMAY), which offers interest subsidies, or inquire about banks which provide a loan with lower EMI options to begin with. The most suitable option needs to be compared in terms of interest rates, processing fees, and the loan tenor given by various bank lenders. Guiding by a home loan specialist may also give you the knowledge that the loan you chose is aligned with your financial capabilities as a person.

Tip 5: Consider a Co-Buyer

Working with a co-buyer, like a friend or a relative, might help you approve a mortgage because you can combine your financial strengths. Nevertheless, this arrangement entails its own set of issues and legal ramifications. Clear agreements containing legal documents are necessary to determine the parties' obligations and exit strategies.

Tip 6: Select the desired Location

The place of your upcoming house has a substantial impact upon the affordability. The prices of the cities are normally higher than in the countryside, but the cities provide much better job opportunities and services. Assess the priority of your lifestyle and work to find an area that provides a decent balance between affordability and quality of life.

Tip 7: Consider Properties in Emerging Locations

Investing in properties located in emerging regions can be a very strategic move for potential home buyers in India. These areas usually feature lower property prices and, thus, should display wider development prospects in future. As for your investment, the expected return will be quite high. Along with the lowered initial costs of a home in a developmental area, you also have a great opportunity to benefit from infrastructure improvement and community improvement. By following this strategy, the prospect of entering the real estate market can be made possible, and your investment has every prospect for higher long-term profit.

Tip 8: Understand All Costs Involved

When planning to buy an apartment, account for all possible expenses—not just the mortgage payments. These include property taxes, home insurance, the costs of regular maintenance, and renovation as well as emergency repairs. By learning these expenses in the initial stage of budgeting, you set yourself aside from financial surprises in the later stages.

You can also read: Advantages Of Buying An Apartment Over Renting

Tip 9: Research government and non-governmental organizations

The majority of the government and non-profit organizations provide programs to facilitate single-income homebuyers. These may consist of down payment assistance, subsidized loans, or tax relief. Utilize your time to conduct research and apply for this assistance since it can offer you considerable financial aid.

Tip 10: Flexibility and patience are the keys to success here

Lastly, purchasing a house on a single salary means being patient and adaptable. The market is quite competitive, and finding the right house that fits within your budget can take time, though. Be ready to readjust your expectations and timeline. Keep in mind that this is a major investment, and making a wrong decision could cause a long-term financial burden. With these suggestions, single-earners can handle the complexity of choosing an apartment and make a decision that will best correspond to their financial situation and lifestyle.

Buying an apartment on a single income is undoubtedly challenging, but with careful planning and the right strategies, it is entirely achievable. By assessing your financial health, budgeting wisely, saving for a significant down payment, and exploring all available loan options and government aids, you can set yourself on a path to successful homeownership. Consider the advantages of co-buying and choosing an affordable location or a fixer-upper to further ease the burden.

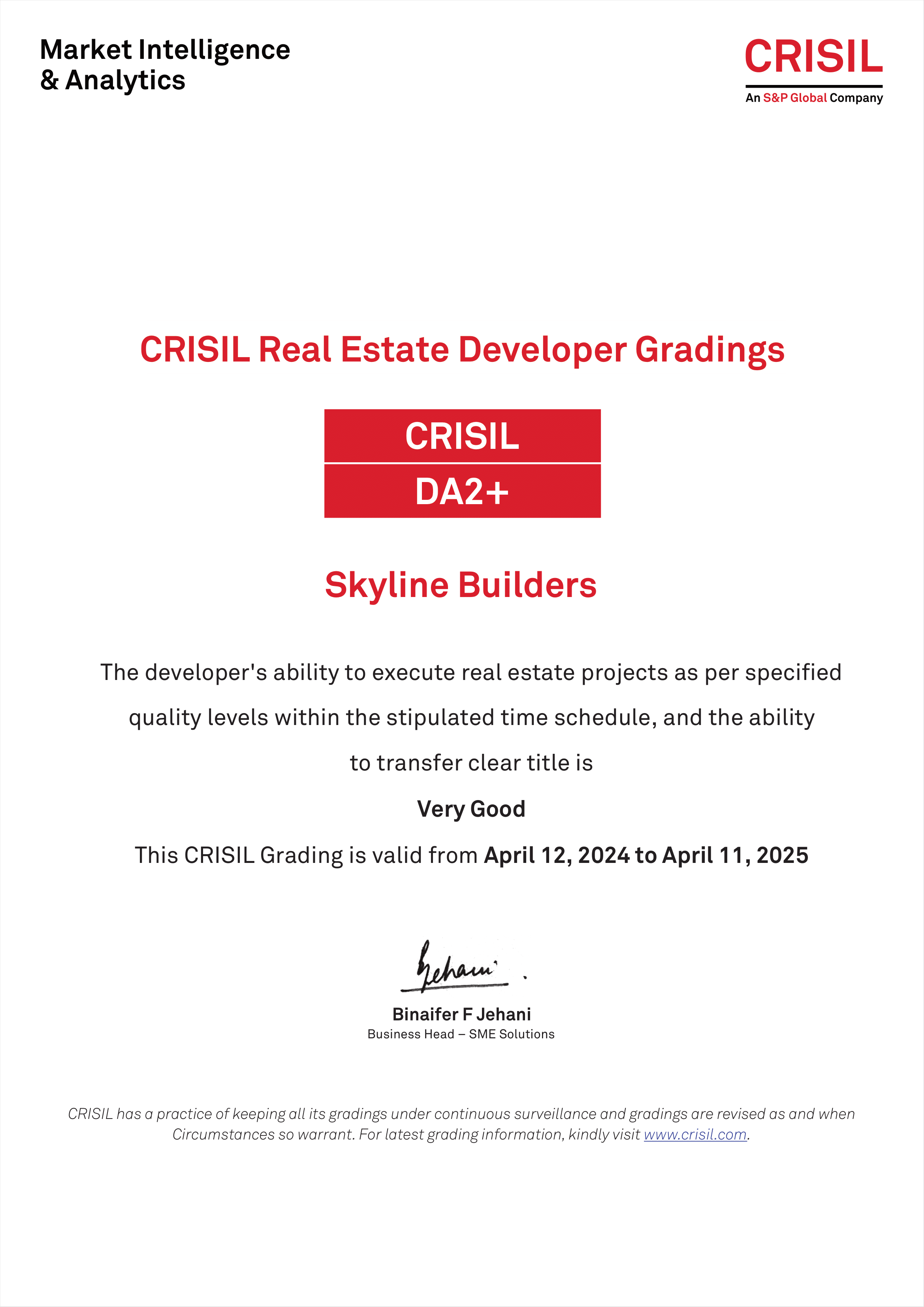

We encourage you to apply these tips diligently in your search for the perfect apartment and to consult with financial advisors to tailor these strategies to your personal circumstances. Remember, every step you take is a move towards securing your own home. Will you let the challenge of a single income hold you back, or will you turn it into your triumph? Explore your options with Skyline Builders, and let your journey to homeownership begin today.

6623aef287d94.png)

63a1a9682edce.png)