Best Financial Plans to Buy Your New Home in 2024

In 2024, analysts foresee a change of direction in real estate affairs driven by economic restructurings and the rising tide of new market conditions. This constantly evolving setting emphasizes the vital importance of strategic financial planning, especially for those who are planning to purchase a new home and deal with the complexities of the process. Being aware of the critical need for preparation, the following blog presents the top financial plans to buy your home in 2024. These plans are crafted to optimize your financial resources in such a way that you can secure your dream home with confidence and ease, as they incorporate smart and adaptive strategies during a fuzzy economy.

Best Financial Plans For Buying a New House

Plan 1: Maximizing Credit Score

Credit score improvement is extremely important for you to buy a house and get the best offer from a bank. A higher CIBIL score will keep you in good books of lenders and you will enjoy the best of interest rates and terms. Commence by looking over your credit report carefully and contesting for any mistakes you come across. Next, concentrate on paying off the existing debts and avoiding new ones. Lowering credit utilization leads to a stronger score. You must be equally diligent about your timely payments - not just on utilities, but also with your other loaning companies. Set up the alerts, if necessary, but do not miss those deadlines.

Plan 2: Smart Saving Strategies

Establishing a robust savings plan is vital for accumulating enough for a down payment. Consider setting up automatic transfers to a dedicated high-interest savings account each payday. Cut unnecessary expenses and review your budget monthly to adjust for more savings. It is also important to review your budget regularly, ideally monthly, to adjust for more savings. These disciplined habits help build your funds steadily and surely.

Plan 3: Government Subsidies and Grants

First-time buyers and some groups of the population may find the financial burden of purchasing a home to be quite high. Fortunately, most governments have subsidies and grants for this purpose enabling them to assist in the reduction of the financial burden of home ownership. Find out about the qualification requirements for such programs since they can offer considerable savings through tax relief, low-interest loans and direct financial assistance, making your first home purchases more feasible.

You can also read: 10 Essential Tips For Buying An Apartment On A Single Income

Plan 4: Investment for Down Payment

If you are planning ahead, then investing in short-term investments like government bonds or low-risk mutual funds should be your priority. These usually have higher yields than saving accounts and, in turn, will speed up your savings for your home down payments. While this is a great way to save for a down payment, you should make sure that the terms of the investment fit your timeline for buying a home so that you can draw on the funds when you need them.

Plan 5: Effective Debt Management

Given the fact that managing existing debt is the most important factor in qualifying for a mortgage, the borrower should keep in mind these important points. The attention should be in improving one's debt to income ratio by paying off high interest debts and steering clear of new large debts. This ratio is computed by dividing monthly debt by gross monthly income. Allotting budgeting tools to monitor spending and repurpose funds into debt repayment is critical. Being proactive in debt management gives an individual not only a better chance of qualifying for a mortgage but also more favourable mortgage terms.

Plan 6: The Funds will be used for retirement.

You can borrow funds from retirement accounts to come up with a home deposit for the first time without being penalized but be careful. Nonetheless, before making this decision, one should understand the implications that are attached to it. For instance, the decision to borrow from your retirement account may reduce your savings in the future and you will probably pay taxes on this. Confer with a financial expert to determine if this is a correct and realistic path for you.

Plan 7: Co-buying Options

Buying a home with a partner or a friend can let you be able to use two incomes so as to reduce a single individual financial burden. Nevertheless, it has to be kept in mind that co-buying, in itself, does not come without risks and challenges. For instance, there may be likely issues that could arise if one party wants to sell the property much earlier or when one party cannot pay his or her share of the mortgage as agreed. To avoid such conflicts or complications, we need to have a clear legal agreement well-defined with everyone's obligations, responsibilities, and exit strategies.

Plan 8: Homebuyer's Insurance Plans

Home buying is a huge event which brings with a big responsibilities and risks. As a result, a homebuyer should take into account homebuyer's insurance products along with the purchase of a new house. These insurance products ensure that unforeseen circumstances, which can arise during home buying and ownership, are covered, thus, giving the homeowner the peace of mind. Homebuyer's insurance products are there to help maintain your investment and guard you against unexpected events like property conflicts, personal difficulties, etc.

If properly used, these financial strategies can boost your confidence as you start your home-buying journey in 2024, giving you strategies that will guarantee a positive and sustainable transition to home ownership.

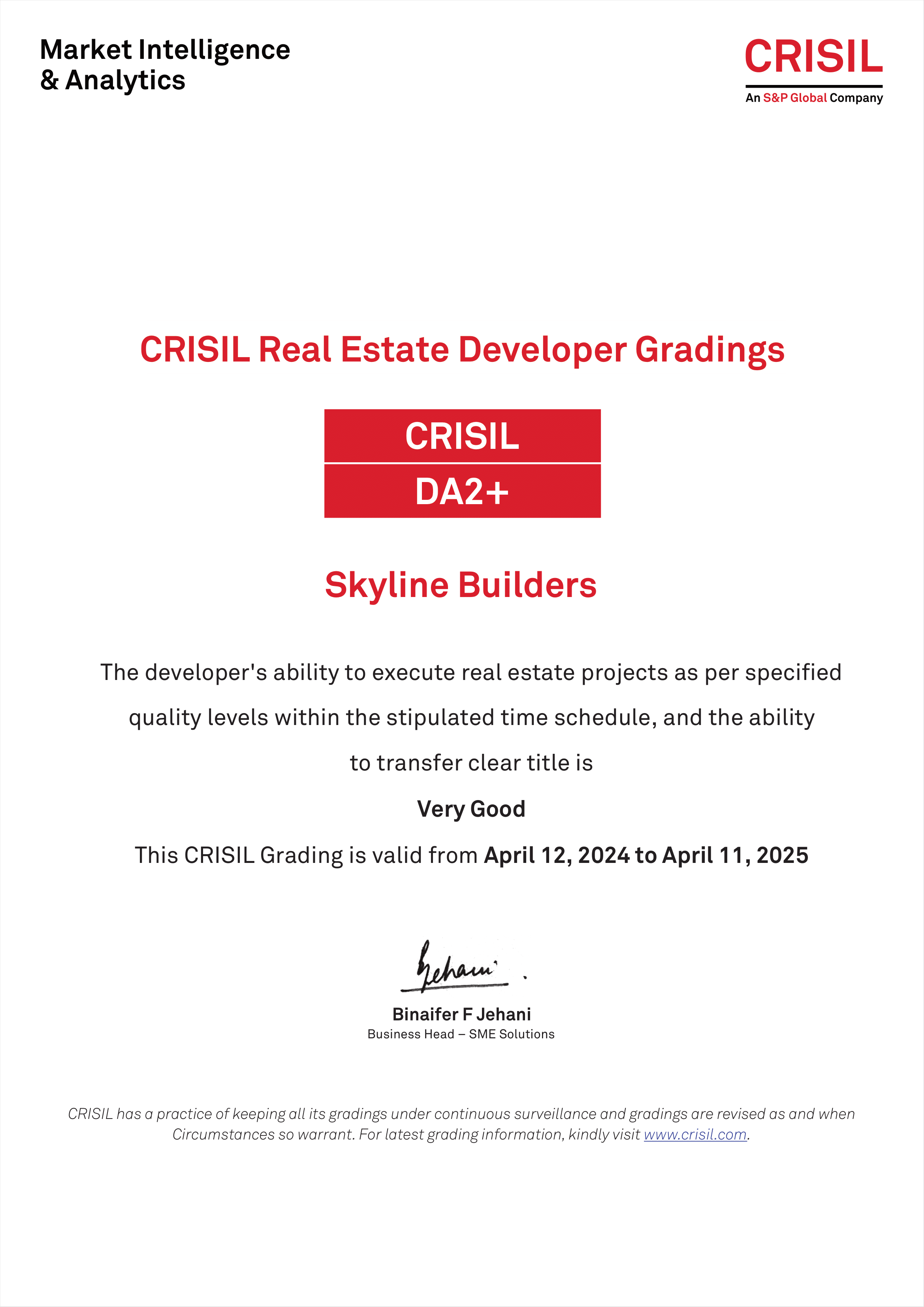

Contact Skyline Builders for more details.

Conclusion

Navigating the home-buying process in 2024 involves meticulous financial planning and well-thought-out actions. We have listed ten solid financial plans starting with the highest credit score, effective debt management and ending with co-buying options. These strategies are not only aimed at helping you buy a house, but they also ensure you can sustain your home financially in the long run.

We urge you to begin using these tactics immediately in order to strengthen your financial base. Are you ready to adjust and make your dream of owning a home come true? Note that every financial situation is different; hence, seeking the help of a financial advisor will ensure that these strategies are customized to suit your needs. Discover new home options and impeccable workmanship with Skyline Homes while you take the first step into this adventure. Your new home is around the corner, and if you do the right things, you will find yourself walking in with confidence and tranquillity.

6623aef287d94.png)

63a1a9682edce.png)