Different types of Home loans in Kerala

The different types of home loans are:

Home purchase loans

Home purchase loans or home loans are the loans offered to individuals for purchasing a new home or pre-owned home. Different banks and financial societies provide different interest rates, normally ranging from 8.5% to 9% for home loans. Some offer a fixed or floating interest rate, which gives us the flexibility to choose according to our regular and fluctuating income sources. In most cases, home loans are offered to buy ready to move-in, under construction or undergoing restoration and extension properties.

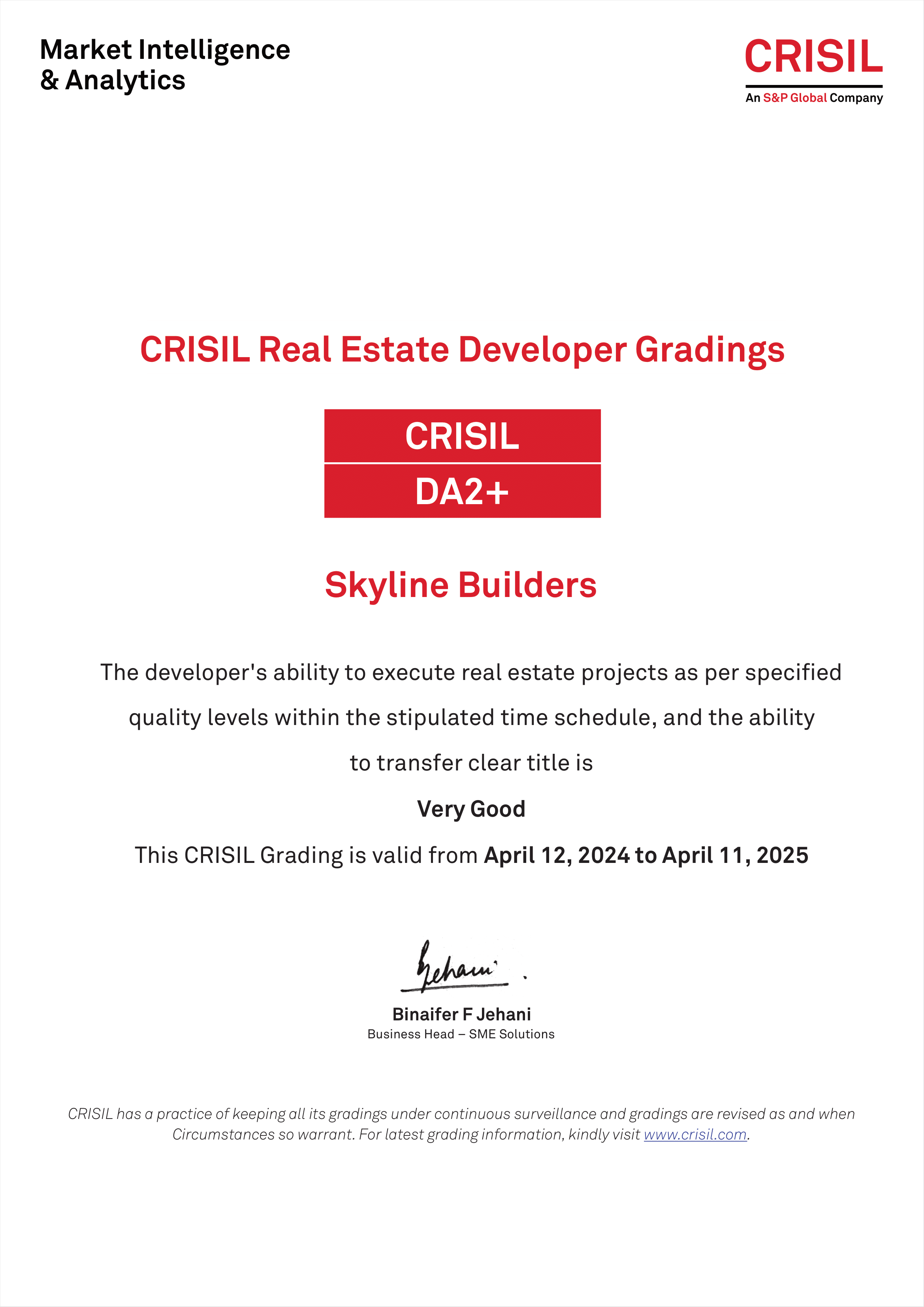

Skyline Builders with 147 projects across Kerala have partnered with prominent banks like HDFC, SBI, ICICI, Axis, Federal, Canara Bank and Corporation Bank to make it convenient and easy approval for their buyers.

NRI home loans

NRI Home loans are specifically designed to cater to the Non-Resident Indians who are interested in buying their dream apartments in Kerala. This loan is a variant of home loans with a few add-on procedures, documentation and formalities. NRIs who are employed abroad for more than six months can avail NRI home loan.

Balance Transfer Loans

Also known as ‘take over loans’, this loan offers the applicants the flexibility to change his/her home loan from one bank to another for many reasons which include dissatisfaction with the current loan provider, lower interest rates or services by other banks etc.

Home improvement loans

Home improvement or renovation loans are availed by those who already own a house, but require extra funds for interior and exterior renovations. The renovations and repair works include internal and external painting, electrical work, water-proofing etc.

Home construction loans

This type of loans caters to applicants who want to construct a house on a plot owned or co-owned by them. Home construction loans are approved based on the rough estimate of your home construction cost. There are certain prerequisites to get the approval for this loan.

The plot or land should have been bought or transferred to the applicant’s name within a year.

The documents required to be submitted for this loan includes the sales deed, approved building plan, and NOC from the respective authority. Banks have the authority to freeze the loan amount in case of any change in the submitted plan or any violation of the law.

Land purchase loans

Land Purchase loans or plot loans are offered to individuals who want to buy land or plot for residential construction.

6623aef287d94.png)

63a1a9682edce.png)